Xeon Protocol

Unlocking the future of Defi | Pioneering next-gen liquidity unlocking tools.

Scroll to dive

XEON Mission

{ Problem }

{ 01 }

Cutting-edge tools for unlocking liquidity cater mainly to Majors, neglecting the significant potential of volatile ERC-20 tokens. Current platforms are rigid and uninspiring, limiting flexibility and user engagement.

{ Mission }

{ 02 }

We are on a mission to build an investor-focused ecosystem of DeFi tools that support liquidity unlocking and risk management for any token on every blockchain.

Ecosystem Tools

Xeon’s Ecosystem compromises 4 platforms:

{ Neon Lend },

{ Neon Hedge

}

{ Neon Swaps

}

& { Neon Farm

}

Pioneering these cutting-edge OTC tools:

Use Cases

{ Call Options }

{ Put Options }

{ Equity Swaps }

{ Crypto Loans }

{ Call Options }

Writer Perspective

{ 01 }

Taker Perspective

{ 02 }

Trade Outcome

{ 03 }

Trade Settlement

{ 04 }

Capo holds 100 BITCOIN tokens. He's in profit but he doubt's it will keep going up. He wants to lock in is profits. He writes a Call Option using his BITCOIN as collateral.

{ Trade Scenario }

{ 01 }

Capo deposits 100 BITCOIN tokens. Valued at $10 per token.

He writes an OTC Call Option: Collateral, 100 BITCOIN tokens, Valued at $1000, Cost $200, Strike Price $12, Duration 30 Days.

{ Trade Scenario }

{ 02 }

Saylor, thinks BITCOIN price will be over $12. He deposits the cost of $200 as cost or premium, and buys the Call Option from Capo.

Saylor guarantees Capos BITCOIN at a value of $1000 for the duration of the deal, if price goes over $12 per token.

{ Trade Scenario }

{ 03 }

During the 30 days, BITCOIN price soars to $20, a gross profit of $800 for Saylor. But Capo pockets the premium paid by Saylor of $200.

Saylor chooses to exercise the Call Option. He takes the profit only, which is the collateral's current market value $2000 minus the agreed strike value $1200 i.e. $800 profit.

{ Trade Scenario }

{ 04 }

Settlement is paid BITCOIN to Capo. The remaining collateral is returned to Saylor.

The deal is closed when Saylor chooses to exercise the option. Had the price of BITCOIN fell to $5 per token; Saylor would only lose $200 to Capo. The cost is the maximum loss Saylor is exposed to no matter the drop in price.

{ Put Options }

Writer Perspective

{ 01 }

Taker Perspective

{ 02 }

Trade Outcome

{ 03 }

Trade Settlement

{ 04 }

Capo holds 100 BITCOIN tokens. He thinks it will keep soaring & wants to earn extra from the bet. He writes a Put Option using his BITCOIN as collateral.

{ Trade Scenario }

{ 01 }

At BITCOIN price $10 per token, Capo deposits 100 BITCOIN as the underlying asset and collateral.

He writes an OTC Put Option: Collateral, 100 BITCOIN tokens, Valued at $1000, Cost $200, Strike Price $8, Duration 30 Days.

{ Trade Scenario }

{ 02 }

Saylor thinks Capo is wrong, BITCOIN will dump and he could profit from the option. He deposits $200 as cost/premium, and buys the Put Option from Capo.

Capo guarantees Saylor a BITCOIN value of $800 for the duration of the deal if price ever falls under $8.

{ Trade Scenario }

{ 03 }

During the 30 days, BITCOIN price falls to $5 per token, a gross profit of $300 for Saylor. But Capo pockets the premium paid by Saylor of $200.

Saylor chooses to exercise the Put Option. He takes the profit only, which is the collateral's strike value $800 minus the current market value $500 i.e. $300 profit.

{ Trade Scenario }

{ 04 }

Settlement is paid in BITCOIN to Saylor. Remaining collateral is returned to Capo.

The deal is closed when Saylor chooses to exercise the option. Had the price of BITCOIN soared to $20 per token; Saylor would only lose $200 to Capo. The cost is the maximum loss Saylor is exposed to.

{ Equity Swaps }

Writer Perspective

{ 01 }

Taker Perspective

{ 02 }

Trade Outcome

{ 03 }

Trade Settlement

{ 04 }

Mike holds Vela. Hes uncertain on price direction the coming week and wants to transfer full gains or losses on his Vela portolio to someone else for the period. He creates an Equity Swap using his Vela as underlying assets for 1 week.

{ Trade Scenario }

{ 01 }

Mike deposits 1000 VELA tokens in the contract as the underlying asset and collateral for the Swap.

Vela is worth $10 so the swap is worth $1000, expiry 7 days time, and he priced the Swap at $100 for buyers.

{ Trade Scenario }

{ 02 }

Saylor, thinks VELA price will go over $10 in 7 days. He deposits collateral $1000 in paired currency.

Saylor buys the Equity Swap with a nortional of $1000; he agrees to take the risk (gains or losses) on Mike's tokens for 7 days.

{ Trade Scenario }

{ 03 }

At the end of the month, VELA price increased to $20.

Saylor found himself in huge profits; all gains accrued in token value are now Saylor's. Current value of Mike's tokens is $2000 and Saylor guaranteed her at $1000 total value/notional.

{ Trade Scenario }

{ 04 }

Settlement paid in quote or paired token.

Mike pays $900 in underlying tokens, stables or WETH to Saylor. The Swap is now closed between Alice and Saylor. If the price had fallen to $5 per token, Mike's bags would be worth $500. Saylor would have to pay the difference; $1000 - $500 (current value) to Mike.

{ Crypto Loans }

Borrower Perspective

{ 01 }

Lender Perspective

{ 02 }

Loan Outcome

{ 03 }

Loan Settlement

{ 04 }

Alex needs liquidity but does not want to sell his GPU tokens. He decides to take a crypto loan using his tokens as collateral.

{ Loan Scenario}

{ 01 }

Alex deposits 1000 GPU tokens as collateral.

He requests to borrow 500 USDT at an interest rate of 5% over 30 days.

{ Loan Scenario}

{ 02 }

Bob, the lender, agrees to Alex's loan request & transfer 500 USDT to Alex.

Bob earns interest while Alex gets the liquidity he needs without selling his GPU tokens.

{ Loan Scenario}

{ 03 }

At the end of the loan term, Alex repays 525 USDT (principal + interest).

If Alex defaults, Bob can claim his total repayment due from the 1000 GPU collateral deposited by Alex. Any remaining collateral is returned to Alex.

{ Loan Scenario}

{ 04 }

Loan settlement ensures Bob receives the agreed interest.

If Alex's GPU collateral decreases in value below the loan amount, Bob can liquidate all of Alex's collateral.

How

it Works

{ Vault token storage }

This illustrates the OTC trading flow, from deposit, writing, taking and settlement.

Scroll to dive

{ Deposit ERC20 Assets }

{ 01 }

Holder decides to move capital from his wallet to our vault to be used as collateral.

{ Write Deal }

{ 02 }

Holder writes a loan request, option or equity swap using deposited tokens as collateral. They specify custom terms for their deal.

{ Buy Deal }

{ 03 }

Takers notice the opportunity to speculate and earn a profit, they deposit and pay the loan request, option or equity swap asking amount.

{ Trade is now Active. }

{ 04 }

{ Deal is binding until expiry. }

In-Deal adjustments or DynamicPacts are available during a deal. .

{ DynamicPacts }

{ 05 }

{ Collateral Topup Requests. }

Either party in the deal can request a collateral Topup. Both parties have to agree for it to be binding and move collateral.

{ DynamicPacts }

{ 06 }

{ Expiry Zap Requests. }

Either party in the deal can request an expiry Zap. Both parties have to agree for it to be binding and change expiry to now.

{ Exercising Right to Settle }

{ 07 }

For specific deals: Options and Loan Requests. Settlement can be before expiry is reached.

{ Settlement by Expiry }

{ 08 }

For Equity Swaps, settlement can be only be done after expiry. For Options and Loan Requests they are deleted or handled as default.

{ Settlement }

{ 09 }

Settlement executed on expiry, funds remain in Vault. Speculator can move profits back to wallet or take more deals.

Protocol Engineering

First OTC Defi Protocol

OTC mechanisms for freedom-enhanced and investor focused Defi trading.

{ Deposit ERC-20s }

{ 01 }

Our protocol accepts any ERC-20 token on the blockchain it's deployed on as collateral in at market value.

{ LOCKDINUSE }

{ 02 }

Tokens locked as collateral on a per-deal basis.

{ PROTOCOL FEES }

{ 03 }

Protocol accumulates trading fees in all tokens.

{ Oracle Pricing }

Robust oracles that cant be manipulated.

{ GET USER BALANCE }

{ 01 }

balances: Deposited, LockedInUse, Withdrawn.

{ WITHDRAWABLE BALANCE }

{ 02 }

Deposited - LockedInUse - Withdrawn

{ WITHDRAW }

{ 03 }

Withdraw tokens back into the depositing wallet address.

{ UNLOCK LIQUIDITY }

Use your collateral across all tools and deals seamlessly. Settlement is synthesized using predefined formulas for each tool.

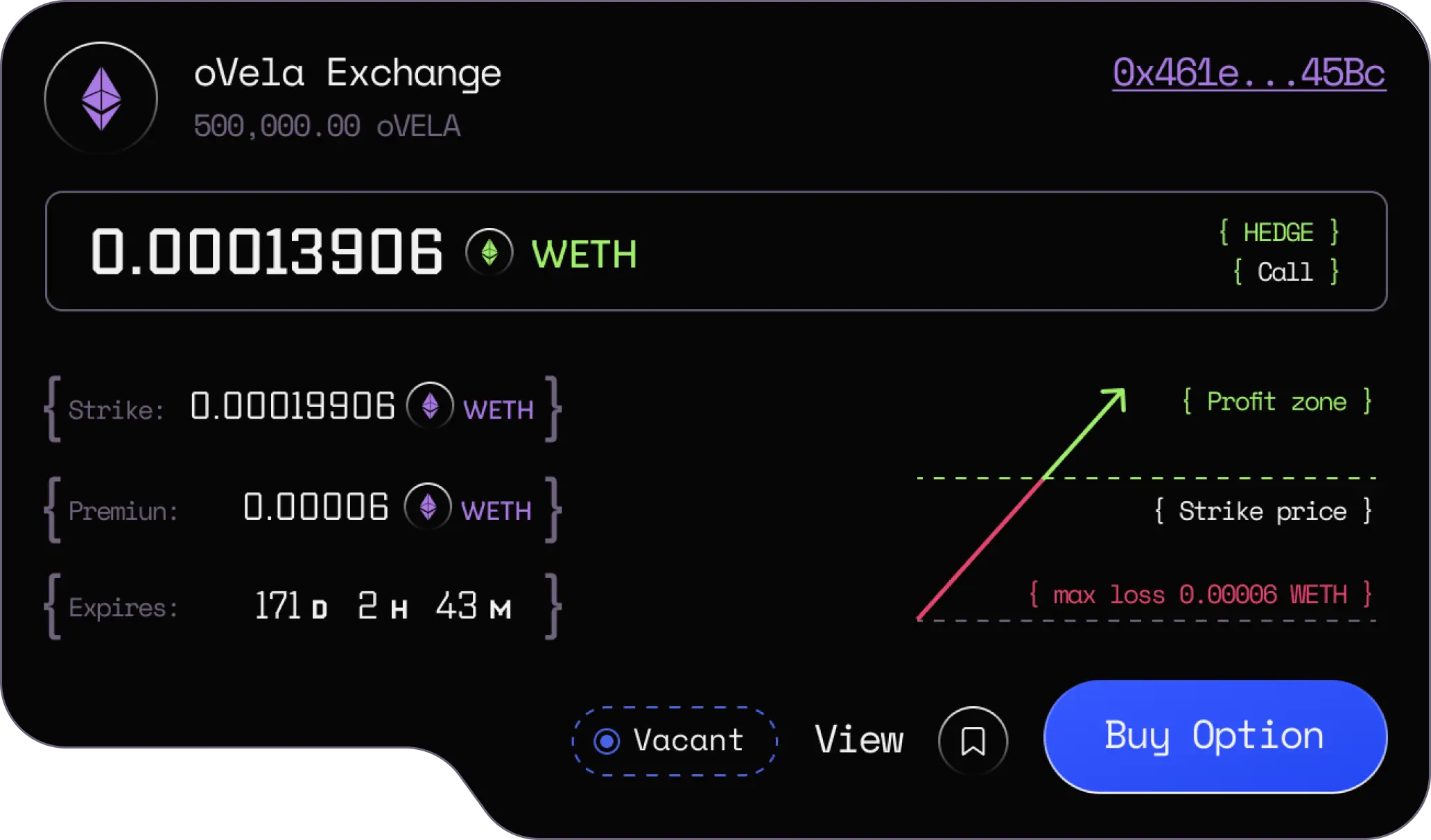

Aesthetic UI

{ June 2024 }

Sample call option card. We're on a mission to create the most user friendly and aesthetically-soothing Dapp UX in web3, coupled with AI for trading assistance.

{ OPTIONS CARD PREVIEW }

Official Articles

Project Timeline

{ BOOM }

{ April 2023 }

Concept inception. Feasibility hackthon done to build a core ERC20 vault in solidity, inspired by Unicrypt. Sample hedge cards designs made. Concept evolution through iterations took over.

{ 01 }

{ 02 }

{ Zenith }

{ Q4 2023 }

Alpha protocol smart contracts complete, dapp front-end design modules and page scripts complete. Initial Alpha testing begins. Updates to protocol and UI, emphasis on UX & functionality.

{ Deep Space }

{ Q1 2024 // Q2 2024 }

Internal testing begins - Alpha testing updates intergrated. Whitepaper V2, Documentation, Closed rationed Initial product previews, Team restructuring, Launch partnerships reachout.

{ 03 }

{ Stargate }

{ Q2 2024 }

Website goes public. Token Launch & TGE event. Testnet Launch plans revealed. Launch of public testnet.

{ Aurora }

{ Q3 2024 }

Team expansion, Testnet campaign launch, Project partnerships to onboard new partners, Ecosystem expansion: multi chain, interfaces, and integrations. Off-chain liquidity sought.

{ 04 }

{ Grand Unification Epoch }

{ Q3 // Q4 2024 }

Mainnet rollout. Apply to join L2 Blockchain Developer Incentives programs. Going Ominchain. Outomated OTC trading. Mass adoption marketing strategy rollout. Updated Whitepaper and timeline.

{ 05 }

{ 06 }

Meet the Team

Partners

ECOSYSTEM TOKEN

{ Taxes }

Ecosystem, Operations

{ DEX Launch }

Initial Market Cap :

{ 5.86 ETH }

Initial Liquidity Pool :

{ 5 ETH }

Visit ECOSYSTEMS and TOKENOMICS to learn about tokenomics and token utility..

{ Live on ETH Mainnet }

Total Supply :

{ 100,000,000 }

Launchpad Supply :

{ 70 % }

Vested Supply :

{ 30 % }

Hard Cap :

{ 70 % }